There are as many reasons to take out life insurance policy as there are types of products! Which means you can usually find cover that suits your circumstances and fits your budget.

You might be wondering, do I need life insurance? And, if so, what kind of life insurance do I need?

In this article, we're going to go through the main reasons to take out a life insurance policy and the type that fits each reason.

Do I need life insurance for a mortgage?

Although it’s not a legal requirement, some mortgage lenders will only lend to you if you have life insurance in place. They may recommend a life insurance provider, but it’s up to you which one you choose.

Taking on a mortgage is a big commitment. And it’s a commitment that doesn’t die with you.

If you die before your mortgage is paid off, that debt will fall to whoever inherits your home. If you have a joint mortgage, it’s likely that your partner will take on the whole debt.

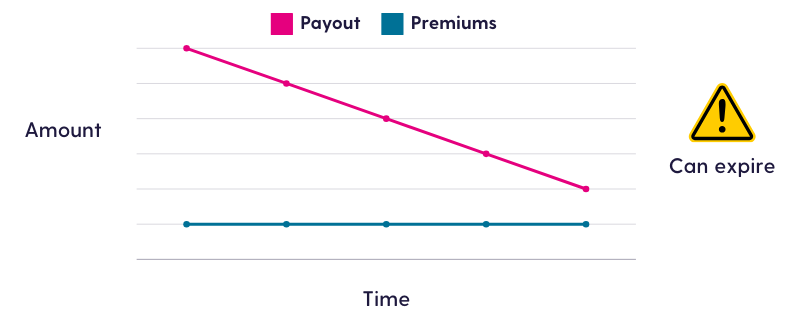

To stop this from happening, you can take out a life insurance product that will pay off whatever's left of your mortgage. This is known as a decreasing term life insurance policy. With this type of policy, the amount the insurance company will pay out goes down as more of your mortgage is paid off, but your premiums stay the same.

Decreasing term life insurance: key facts

- The payout for your policy will go down with time. Similarly, as you’ll be making mortgage payments while you’re still around, the amount you owe on your mortgage will also go down over time.

- Despite your payout going down, your premiums stay the same throughout the entire term of your policy (unless you request changes to your policy). This is why this type of policy tends to be cheaper than some others.

- Many decreasing term life insurance policies are flexible in terms of how much cover you want and how long you want your policy term to be.

- You can also include critical illness cover, which pays out if you are diagnosed with a serious health condition.*

Do I need life insurance when I get married or have children?

If there are people who depend on you to keep the lights on and the fridge full, they might find themselves in financial trouble if you weren’t around.

When people rely on your financially, you’ll likely want to make sure they’ll be looked after if something happened to you.

There are two types of life insurance you might consider, level term and increasing term.

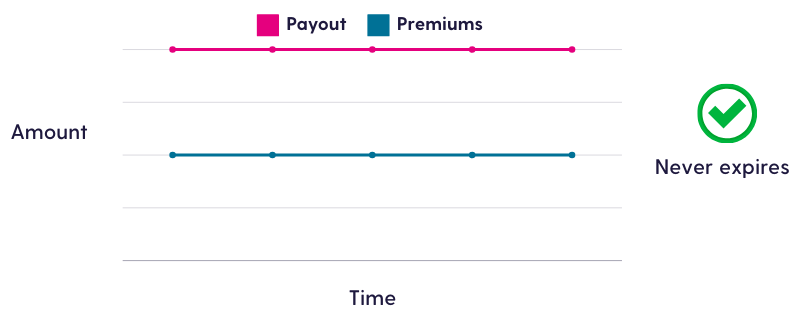

Level term life insurance is designed to pay out a guaranteed amount when you die. This means you can make sure there's enough to cover your family’s needs when you take out the policy. However, the amount they need might increase over time as costs go up.

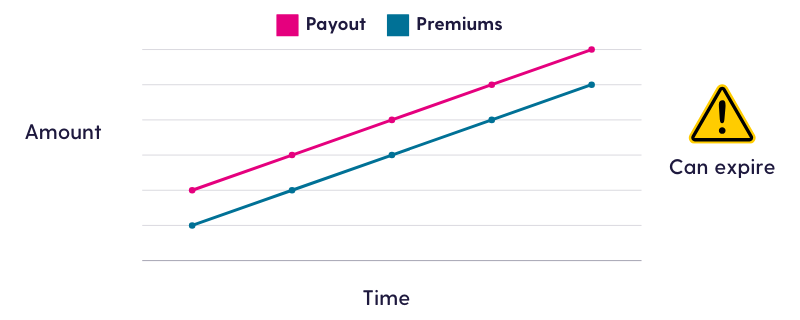

With increasing term life insurance, the payout increases over time to keep up with inflation. So you’ll likely end up paying higher premiums as time goes on. This can be a good option if you’re worried about how rises in inflation could affect your family’s financial situation.

Level term life insurance: key facts

- Throughout the length of your term, your premiums stay the same (unless you make changes to your policy). Your payout also stays the same.

- You agree on the amount of cover you’ll receive and the length of your policy term when you first take out your policy.

- The younger you are when you take it out, the cheaper your premiums tend to be.

- While you’ll know exactly how much your family would get, this might not keep up with inflation.

- Just like other life insurance policies, critical illness cover may be offered as an add-on or included in your policy.

- Premiums tend to be more expensive than for decreasing term life insurance policies.

- There’s a possibility that the payout could get hit by inheritance tax, but you can guard against this by placing your policy in trust. This keeps the payout out of your estate, meaning inheritance tax doesn't need to be paid on it.

Increasing term life insurance: key facts

- Like level term life insurance, you agree on the length of your policy term with your provider when you take out the insurance.

- With increasing term life insurance, both your premiums and your payout will be reviewed annually. Both are likely to increase over time to keep up with inflation.

Could life insurance help pay for your funeral?

Your funeral might not be something you want to think about. But when you’re looking at life insurance, it’s worth considering how much your funeral could cost and how your family would need to pay for it.

Whole of life insurance guarantees a payout when you die, regardless of when that is. This means that your cover will never expire.

Whole of life insurance

There are a few different types of whole of life insurance:

- Over 50s guaranteed acceptance cover policies, such as OneFamily’s Over 50s Life Cover, don’t require a medical check. Some, like OneFamily’s, come with the option to have the proceeds of your policy go directly towards paying for your funeral. There’s usually a 12-month cooldown period before you can make a claim.

- Whole of life pure protection covers you for life and starts straightaway. But you might have to go through medical checks to be accepted.

- Whole of life investment-linked policies give you the option of investing your premiums. You can either choose an investment fund or leave the decision up to your provider.

OneFamily's Over 50s Life Cover

OneFamily’s Over 50s Life Cover is an over 50s guaranteed acceptance policy.

There are no medical checks required, meaning you’re guaranteed to be accepted as long as you’re a UK resident between 50 and 80 years old. From age 90, you’ll stop paying your premiums, but you’ll still be covered until you die.

Our Over 50s Life Cover policy also comes with terminal illness cover by default, as well as Funeral Funding. With Funeral Funding, your policy is paid directly to your funeral provider when you die, giving your family peace of mind at a difficult time.

*The types of illness covered by critical illness will vary between policies and providers.

OneFamily's Over 50s Life Cover

Give yourself and your loved ones peace of mind with our simple, affordable life cover for over 50s.