Lifetime ISA charges and fees

There are two main costs to be aware of when you open a lifetime ISA: the government withdrawal fee and any provider charges.

Like all ISAs, lifetime ISAs are tax-exempt, meaning you won't need to pay any income tax or capital gains tax on the money you take out, no matter how much your lifetime ISA has grown.

However, you may need to pay a government withdrawal fee if you go against the lifetime ISA rules, and your provider may have some charges.

Let's take a closer look at the charges you can expect to pay if you open a OneFamily Lifetime ISA.

Lifetime ISA government withdrawal fee

You will be charged the lifetime ISA government withdrawal fee if you:

- Withdraw money from your lifetime ISA within 12 months of your first payment into it

- Take money directly out of your lifetime ISA, rather than through a conveyancing solicitor to buy your first home

The exception to this is if you are 60 or over. At this point, you can withdraw as much as you like without being charged a penalty fee.

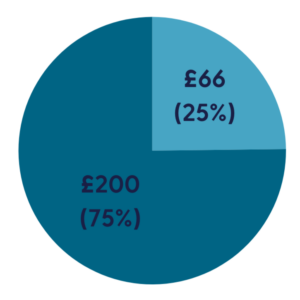

The lifetime ISA government withdrawal fee is 25% of everything you withdraw from your account. To put it another way, you will only get 75% of the money you withdraw.

So, the less you take out, the smaller the fee you'll pay.

When you withdraw money, an additional amount is taken out to cover the fee and this is sent to HMRC on your behalf.

OneFamily's Lifetime ISA charges

We like to keep things simple and straightforward, which is why we charge just one fee for managing your Lifetime ISA, the Annual Management Charge.

Our Annual Management Charge is 1.1% of the total value of your Lifetime ISA.

The Annual Management Charge simply covers the cost of managing your investment each year. The charge is calculated daily but you'll only pay it once a year, and it's applied to the fund as a whole, so it’s never taken directly from your original investment.

There may be other costs in some exceptional circumstances, for example reissuing cheques. If we do intend to charge you for anything else, we'll let you know before we do.

Other providers will have different charges.

Do OneFamily's Lifetime ISA charges ever change?

Sometimes these charges may change. This can happen if the costs of running the fund, or of providing account services to you, go up.

We will always contact you in writing before making any changes. This forms part of our agreement, set out to protect your money and interests at all times.

Our Key Information Documents for the OneFamily Global Equity Fund and Global Mixed Investment Fund provide an indication of different possible scenarios, and how this may affect your investment.

The total costs take into account one-off, ongoing and incidental costs.

Lifetime ISA minimum deposit

We believe in starting small. That’s why all we have a low minimum opening deposit - you can open a OneFamily Lifetime ISA with a £25 monthly direct debit, or £250 lump sum.

As our Lifetime ISA invests in stocks and shares, we recommend that you keep your money invested for five years or more.

Money invested for longer periods can increase the potential of better returns. This is because you'll have longer to ride out any fluctuations in the stock market.

The value of stocks and shares can fall as well as rise, so you could get back less than was paid in. If you're not sure a stocks and shares Lifetime ISA is right for you, please contact an independent financial adviser.

About our Lifetime ISA

You may also be interested in:

What is a Lifetime ISA?

A lifetime ISA is an ISA with a government bonus that can help you save for your first home or retirement.

Lifetime ISA: cash vs stocks and shares

Have you thought about whether to open a lifetime ISA that saves in cash or one that invests in stocks and shares?

How to save for retirement when you’re self employed

As a self-employed person you don’t get automatically enrolled in a workplace pension. How can you save for retirement?

How to use a lifetime ISA to buy your first home

Buying a house can be a complicated process, so how does your lifetime ISA fit in?